sales@onourdoorstep.co.uk

07967 978831

Check in for great community and seasonal features, local history and marketing blogs.

We hope you enjoy the read!

WELCOME TO OUR SPECIAL FEATURES PAGE

COMMUNITY INTEREST • LOCAL BUSINESS

Check in for great community and seasonal features, local history and marketing blogs.

We hope you enjoy the read!

1690992947000

6 Steps to Financial Freedom

Personal Finance Tips for your Local Personal Financial Adviser For many people, the new wealth is freedom. Be that time, location or financial freedom: it doesn’talways mean having millions in the bank, it’s just having enough to live the life you want.I am sharing six of my favourite tips on how to get there. Have a Financial PlanA clear plan and budget can help you to speed up reaching your financial goals. When you become more conscious of your spending, it’s amazing what you can achieve. Having a plan isn’t about deprivingyourself, it’s about living with a little discipline to avoid a life of deprivation. My job is to help you figure out how to live the life you want. Build Good HabitsHow we think about money can have a huge impact on how we manage it. Many of our money habitsare subconscious. Building good financial habits isn’t necessarily about the things you’re doing butmore the person you’re becoming. You don’t need a wealthy background to create wealth. Have an Opportunity FundLife throws up surprises. An opportunity fund is 3-6 months worth of expenditure in cash savings which you can rely upon if needed. Emergencies do happen, so having this fund allows you to deal with them. Spending money on emergencies isn’t fun but it is better to have it than need it. Make Sure you are ProtectedProtection (i.e. life insurance, critical illness and income protection) is often overlooked but in my opinion it’s the base of any financial plan. You can save as much as you like but if you become ill or a loved one passes, it’s crazy how fast savings can deplete and your life can change. I make sure that you protect what matters the most. PensionsContributing to a pension is one of the most effective forms of savings. Not only do you receive valuable tax benefits but if you are employed, you receive extra contributions from your employer. If you own a Limited Company, pension contributions are an allowable business expense and can reduce your corporation tax bill. Start InvestingInvesting should be for your long term savings and you can start small at any point in your life. The power of time & compound interest can be so impactful. Investing is one of the best ways to build wealth. It is my job to ensure that you are choosing the right investments for you whilst investing in the most tax efficient way. Make sure you are on the right path to achieve financial freedom. Hannah Whiteley DipPFSFinancial AdviserE: hannah.whiteley@sjpp.co.ukT: 07521 154377

1690991430000

Bridgewater Halfpenny

The coin above is an example of a Conder token. Conder coins (also known as provincial tokens) were produced in the eighteenth and nineteenth centuries and were privately minted by business owners, partly due to the lack of small denomination coinage in circulation. The government made little effort to stop the practice and thousands of designs were produced. Conder tokens are named after James Conder who was an early collector and cataloguer of the tokens.The 10g copper coin pictured shows a man carrying a load on his back, with the lettering “ManchesterHalfpenny 1793”. The reverse bears the words “Success to Navigation” and a coat of arms. The coatof arms clearly shows the Bridgewater coat of arms with the lion rampant, crested by a crown. The‘navigation’ refers to the Bridgewater Canal. There is also an inscription around the edge with differenttypes produced. This presumably prevented ‘clipping’ - the taking of a small amount of metal off the edge of hand-struck coins to be melted and sold or used to make new coins. Does anyone know anything further about these coins? Who produced them and where were they used?In later years the private production of such coins was clamped down upon as it could be used by unscrupulous employers to force workers to use their shops (this is known as the ‘truck system’). Private token coinage was banned in 1817 and the truck system came to an end (supposedly) with theTruck Act of 1831. Thank you to Mark Charnley for supplying information for this article. Other sources include Wikipedia. If you are interested in local history you will be very welcome at Eccles & District History Society.Meetings run from September to May. For details of their programme, go tohttps://edhs.chessck.co.uk

1685791049000

Swinton Heritage Trail

Many places have heritage trails, including a number of areas in Salford. Some are very prominent and hard to miss but when I speak to people about ours in Swinton, very often they are unaware of its existence. The reason for this is probably because the eleven bronze plaques that make up the trail are at ground level and people tend to walk over or past them without even realising they are there. The trail was conceived by the Swinton Heritage Task Group, which is a community group of council representatives and local historians who currently meet quarterly online. Financing the trail was down to Section 106 money from Asda. When they built a car park for their new Swinton store, which opened in 2014, their development included building on the site of the burial ground of the former Unitarian Chapel that had been on Swinton Hall Road and for the privilege they were required to provide 106 money for community use. Although people might overlook the plaques, there is a very prominent pink notice board near the Lancastrian Hall facing Salford Civic Centre that shows the locations of all the eleven plaques on the trail. The plaques are located at the sites (or former sites) of: • Swinton Industrial School• St. Peter’s Church• Swinton Public Gardens*• Station Road Rugby Ground• Unitarian Church• Swinton Hall• St. Augustine’s Church• Clifton Hall Tunnel Collapse (Temple Drive)• Victoria Park• White Lion Pub• Chorley Road Rugby Ground*The Swinton Public Gardens plaque is at the Garden’s entrance, which is on Chorley Road on the opposite side to the Police Station. In the Gardens is a memorial to Noah Robinson (1826-1907) who has been referred to as the “founding father” of modern Swinton in a local history pamphlet written by Derek Antrobus, a member of Swinton Heritage Task Group. Noah, who occupied a number of key posts in our area, including being a Poor Law Guardian, a Chairman of Swinton Local Board and a Churchwarden at St. Peter’s Church, is also commemorated in several features of that church, including on its Lych Gate. Sometimes there are opportunities to undertake guided tours of the trail, when further information relating to each of the locations can be shared,although each plaque has sufficient information on it to encourage people to start to research our local Swinton heritage for themselves. There will be an opportunity for people to learn more about the heritage of this area, prior to its incorporation into the City of Salford in 1974, when Derek Antrobus mounts a free exhibition entitled “Celebrating Swinton and Pendlebury’s Story” at Swinton Gateway. This will commence 24th June and continue for about three months. Written by Paul SherlockAgeUk SWINTON & Irwell Valley History group

1685787720000

5 Steps To Networking For Success

Networking in business. How does this make you feel? Some business owners really enjoy networking, getting out and meeting new people. For some, just the thought of it actually stops them from attending events...and this is such a shame, as I see networking as one of THE best ways to grow your audience, grow your confidence and grow your business. Hello there, I’m Janine Friston, founder of the Female Business Network, and I’m on a mission to help people network the right way, and go from “networking-hesitant”, to “networking-confident” - confident in trying some new things, to challenging yourself and understanding how networking can, and should be part of your marketing and business strategy. So, whether you’re experienced at networking, or new to this activity, I’d like to share some of my networking tips with you. Top 5 tips for networking success1) Don’t sell - if all you do is promote your business and sell, this turns people away. People generally don’t like being sold to. Introduce your business and how you help your clients. If people want to find out more they can approach you to ask. 2)Have conversations - ask questions, listen, add value and have genuine conversations. This will also help you relax at the event. 3) Take a buddy with you if you’re nervous about attending an event. This will help you with that initial walk into the room. But, make sure that you don’t spend all of the event talking to your friend. Challenge yourself to speak with just one new person at each event, and before you know it you’ll be growing your audience and becoming more confident. 4) Follow up after the meeting - connect with and message people you’ve met at an event, maybe arrange to have a coffee or a call to get to know each other more. Start to build that relationship. 5) Be consistent - like all things in business, you have to show up consistently. So, make sure you attend as many of the group events as you can. People need to get to KNOW you, LIKE you and TRUST you. And finally, have fun - running a business is the best thing, so enjoy meeting people, growing friendships, growing your community and growing your business as a result of networking the right way!If you’d like to join a friendly online networking community, then the Female Business Club membership could be for you. We have members from the local area, as well as across the UK. So, if you want to network with friendly and supportive women in business, and get help in achieving your business plans and goals, then I’d love to welcome you into our community. Please check out the Female Business Club or get in touch with me.Email: janine@femalebusinessnetwork.co.uk www.femalebusinessnetwork.co.uk

1680537264000

Social Media Content Tips for Local Businesses

Business Marketing Tips by Monton Business Group We asked local networking group, Monton Business Group, to share their top tips on how local businesses can plan their social media content, ensuring they run interesting and engaging posts for their audience to read. 1) Write your content out in advanceIt’s super helpful to create a calendar on a Word document for example, so that you can write posts in advance. You don’t have to post every day – posting content every few days, or even once a week is enough, depending on the type of business you have, the number of products/services you sell, and if you have enough content stored up. 2) Create bespoke graphicsUse platforms such as Canva.com where even on a free account you can design your own bespoke images. However, there are also lots of templates you can use which allow you to change the colours to match your own brand. Make sure you add your logo on to all of your graphics to generate brand consistency with your followers. 3) Share informative and engaging contentMix up your content to include the benefits of using your business as well as examples of customer reviews. You can even promote the services of your customers on your social media! Use national holidays and events to help generate engaging content, for example can your product or service tie into Mother’s Day? Alternatively, simply put out a post wishing your followers a Happy Mother’s Day! Use an online ‘Social Media Calendar’ to find out about special days in the month that you’re planning your social media content. 4) Use a social media scheduling toolWhilst Facebook and Instagram allow you to post to both platforms through their built-in social media planning and scheduling tool, other more dedicated software such as Hootsuite, Buffer and Later allow you to schedule content to all your social media accounts simultaneously. Some of these planning tools offer a free month trial so be sure to utilise this and get yourself set up and in the rhythm of pre-writing and scheduling your social media content. 5) Connect and engage positively on social mediaDon’t just churn out content without engaging on social media. Make sure you are following your customers and contacts (who in turn will follow you), as well as regularly ‘liking’, ‘sharing’ and ‘commenting’ on their posts. If people are engaging on your posts with replies and comments, it is good practice to continue the conversation by liking their comments andresponding with an answer to a question they might have asked, or even a simple ‘thank you’ for kind words they may have said about you or your post. For more business advice from local companies, come along to a Monton Business Group networking event on the last Friday every month. Visit montonbusinessgroup.com to find out more and to register your details. Follow us on Facebook, Instagram and LinkedIn.

1675435203000

How to Reduce your Debts

Debt is something that everyone has at some point in their lives. Whether you owe money from loans, credit cards or store cards, debt is never fun to deal with. Debt is often associated with negative feelings such as anxiety, worry, stress, frustration; it has a huge impact on our lives. Debt affects us in many ways: emotionally, mentally, physically, socially and spiritually. If you are dealing with debt, then you probably face these challenges. Many people struggle to pay off their debts because they don't know where to begin, which adds to the emotional turmoil. The key is to think about it logically and take it one step at a time. Step 1: Set a BudgetSet a budget for how much you can realistically afford to allocate each month to pay off your debt and make a commitment to stick to it. Step 2: PrioritiseMake a list of all your debts with the name of the creditor, total amount owed, minimum monthly payment and interest rate. Choose the debt with the highest interest rate and prioritise paying that one off. Then choose the next highest rate, then the next, and so on. You’ll get out of debt faster and faster as you move down the list. Step 3: Pay More Than the Minimum BalanceIf it’s feasible, always pay more than the minimum payment on any outstanding balance – even £10 or £20 a month can make a big difference. You’ll pay less interest, reduce the amount owed more quickly, and improve your credit rating. Step 4: Use Cash Rather than a Credit CardAlthough credit cards are a great convenience, they’re also an easy, and expensive, way to create debt. A good way to gain better control over your finances is to wean yourself off using credit cards to pay for everything. If you can, try to use more cash to pay for everyday or smaller items: it will leave you with more funds to channel into reducing your debt. Step 5: Have a GoalPick a date when you plan to be completely debt-free. It’s easier to keep yourself motivated when you have a goal rather than believing that you’ll be paying off your debt forever. Think about how you’ll feel when that day comes and visualise how you will celebrate! What if you have no money to pay off your debt?If you don’t have any spare cash to help pay down your debt then all is not lost. There are still options such as debt management plans, individual voluntary arrangements, administration orders, debt relief orders and bankruptcy orders. You’ll find free debt advice at moneyhelper.co.uk and citizensadvice.co.uk. If your debt is having a detrimental effect on you mentally, mind.org.uk has lots of practical tips on managing your money and improving your mental health. About the Author: Helen Say is a freelance copywriter and blogger www.cblservices.co.uk

1666098072000

How to keep building your small business, even in a recession.

What Do Customers Want from Local Businesses? Customers trust and use local businesses, and even prefer them to national chains.More than 80% of consumers use local businesses, not just out of necessity, but out of preference. They like using local businesses because they...• Offer a more personalised service• Are trustworthy and treat customers fairly• Provide better customer service• Deliver quality work / products which they are passionate about• Are more reliable • Staff are professional and more knowledgeable about the products As we head into a tough economic period, it is important to play to these strengths and keep the community coming back and supporting small independent business owners. What can small business improve on? Although local businesses are doing a lot of things right, there’s still room for improvement.Here’s what customers want to see more of from local businesses: • Online reviews:Consumers are turning to reviews and social media more often to find companies, and they expect to see reviews they can use to make buying decisions. • Simple-to-use websites:Do you have a website? Is it clear and simple to use? When was the last time you reviewed it...perhaps it is time to update it? • Special offers for returning customers:Attract more repeat custom by rewarding your existing clients with specials, deals, and offers. It is far easier to generate more sales / visits from existing clients than to find new clients. • Self-service:Customer want to be able to book appointments, manage billing and make payments to local businesses online. Is this something you could offer / develop on your website? • More frequent online communications:Keep in touch with your customers - they like to get communications such as appointment reminders, advice and helpful tips, product updates, requests for feedback, newsletters etc.... It's a great way to add value, offer a better service than your competitors, and to keep your business at the forefront of your customers' minds too. So, whilst facing a tough 6-12 months ahead, there are many ways we can improve the service we offer, attract more customers and keep building our businesses...even in a recession.

1653770352000

Worsley May Queen

Step back in time to 1875 and find out about Worsley's annual May Queen Festival.

1643371047000

New Highway Code Rules for 2022

The Highway Code has received a refresh, with a new set of rules coming into force from 29th January 2022. As well as some 49 existing laws having been updated, new rules will be introduced. The changes are extensive and further information is available on the website link located at the bottom of this article. However, the key areas are summarised below. Hierarchy of Road UsersPreviously The Highway Code stated all road users should be considerate towards each other, applying this principle to pedestrians and drivers equally. It meant that equal responsibility was originally placed on all road users for assuring the safety of others. The new hierarchy places responsibility on road users who could do greatest harm to others, and it is with them that the greatest obligation to protect the most vulnerable on the road now lies. Top of the hierarchy are lorry drivers, cars, vans buses and motorcycles. But it should be noted that cyclists, horse riders and horse-drawn carriage drivers have a greater responsibility to reduce the danger posed to pedestrians. Pedestrian Priorities at JunctionsPrior to the rule change, road users would have given way to pedestrians who have started to cross the road into which they are turning. Under the new rules priority must be given to pedestrians who are waiting to cross the road, which means that if you are about to turn into a road and a pedestrian is waiting to cross, you should give way. New Rule for Drivers and Motorcyclists at JunctionsThe new rule states that when turning into or out of a junction, drivers should not cut across the path of any other road user, including cyclists, horse riders or horse-drawn vehicles, if doing so would cause the other road-user to slow down, stop or swerve. Safe Passing Distances An amendment to existing Rule 163 sets out safe passing distances for drivers when overtaking cyclists, motorcyclists, horse riders and those in horse-drawn carriages. Drivers must give at least a 1.5 metre space when overtaking a cyclist at speeds of up to 30mph. More space should be allowed when overtaking at speeds of more than 30mph. Rule 72 establishes the right for cyclists to ride in the centre of their lane, to ensure that they remain visible. When passing a pedestrian who is walking in the road, drivers should allow at least two metres of space and maintain a low speed. Rule 213 has also changed and now states that on narrow sections of roads, horse riders may ride in the centre of the lane and drivers should allow them to do so for their own safety, to ensure they can see and be seen. Drivers should pass a horse at least 2 metres distance and at a slow speed. In all cases, drivers will now have to wait behind a motorcyclist, cyclist, horse rider, horse-drawn vehicle or pedestrian and not overtake if it is unsafe or not possible to meet these clearances. Extra care should be taken in poor weather, including high winds. For a more in-depth look at the new rules, visit:https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1037306/table-of-change-to-the-highway-code.pdf

1642702156000

Why does your local business need marketing?

There is only ONE reason:

If people can’t see you then they’ll pick your competitor!

1634146337000

Travel Car-FREE to RHS Bridgewater

The first phase of RHS Greenway, a new traffic-free walking and cycling route is now open.

1627407740000

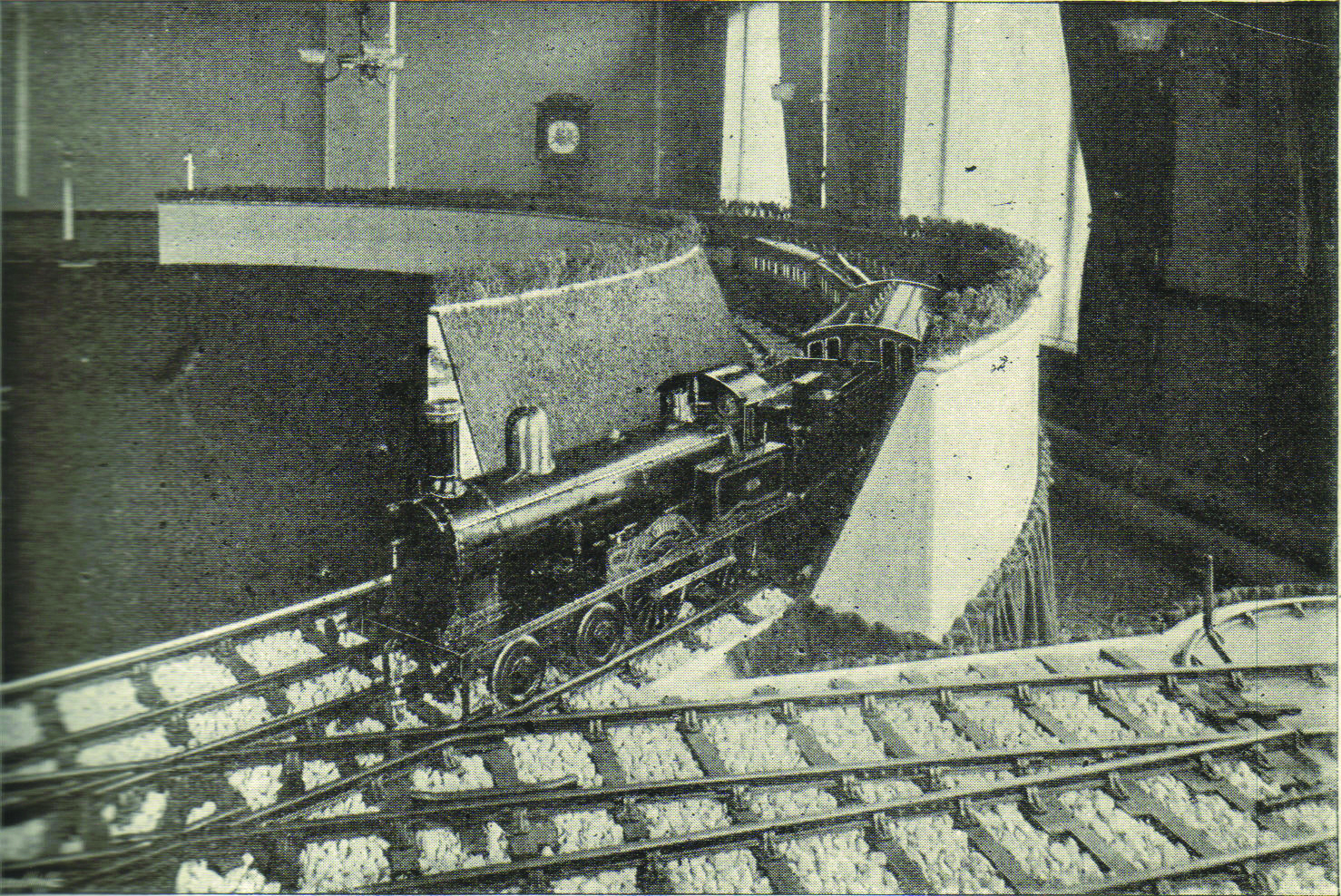

Worsley's Model Railway

The most expensive model railway in the world!

View Albums